WHAT IS TALENT DISRUPTION ?

A talent disruption is the process by which traditional labor ends and talent shifts from legacy full-time employment to higher paying, more flexible work, facilitated by technologies that empower individuals to build a personal brand. As disruption grows, talent ruthlessly migrates to the highest paying and most flexible sources of work, leapfrogging inefficiencies in hierarchies of legacy industries

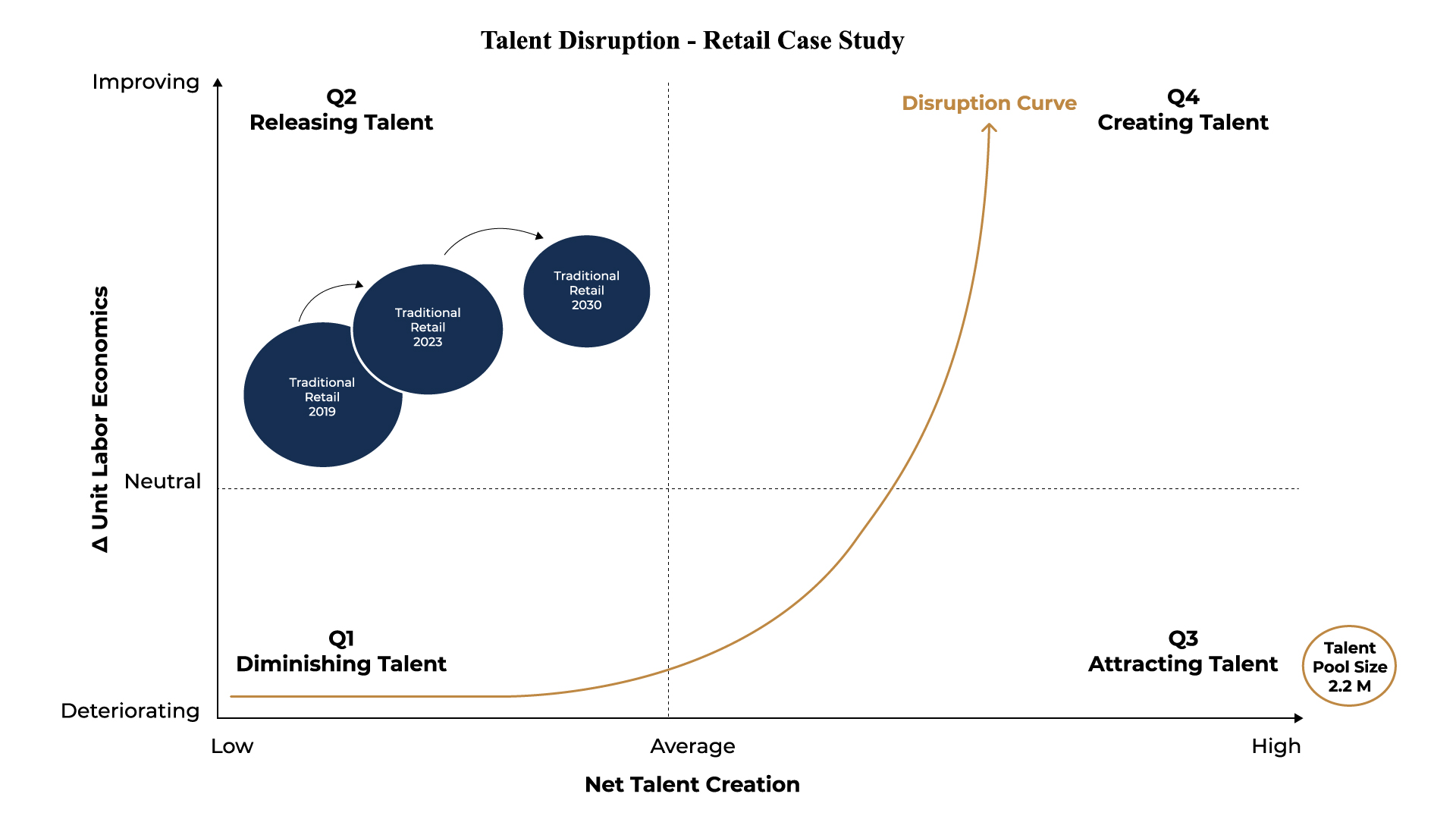

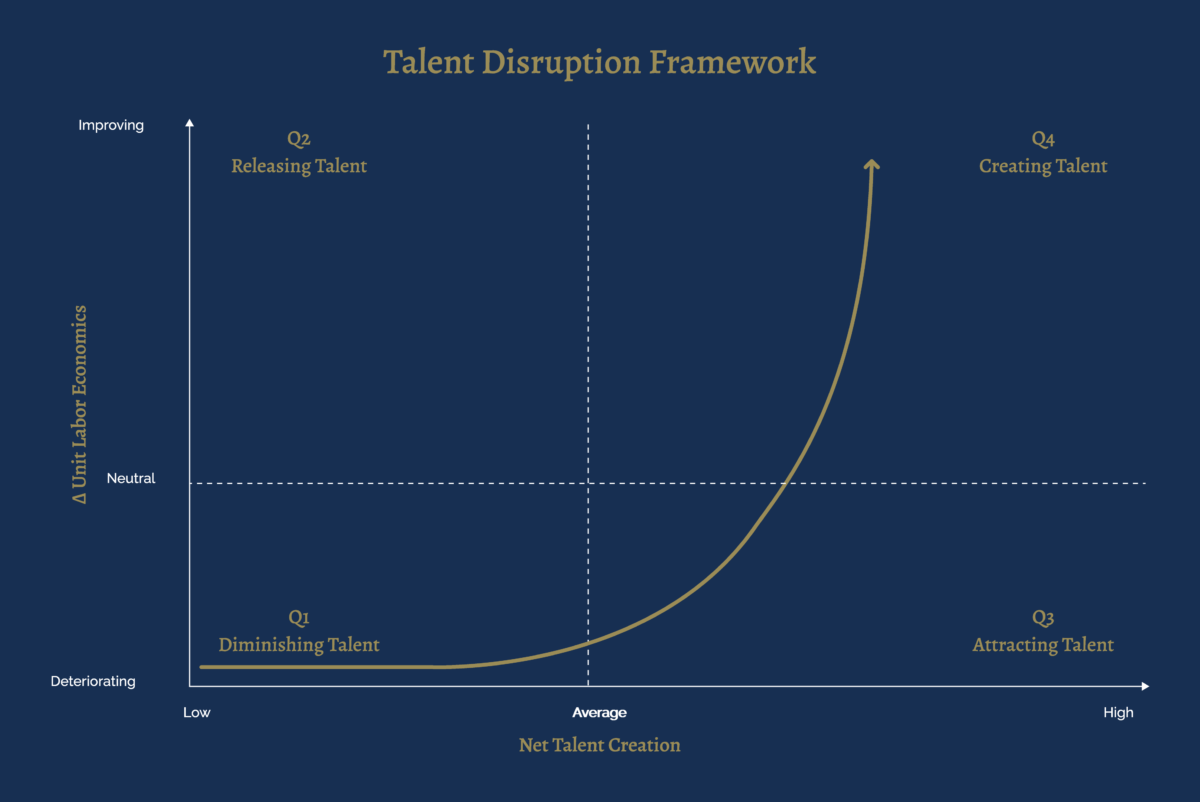

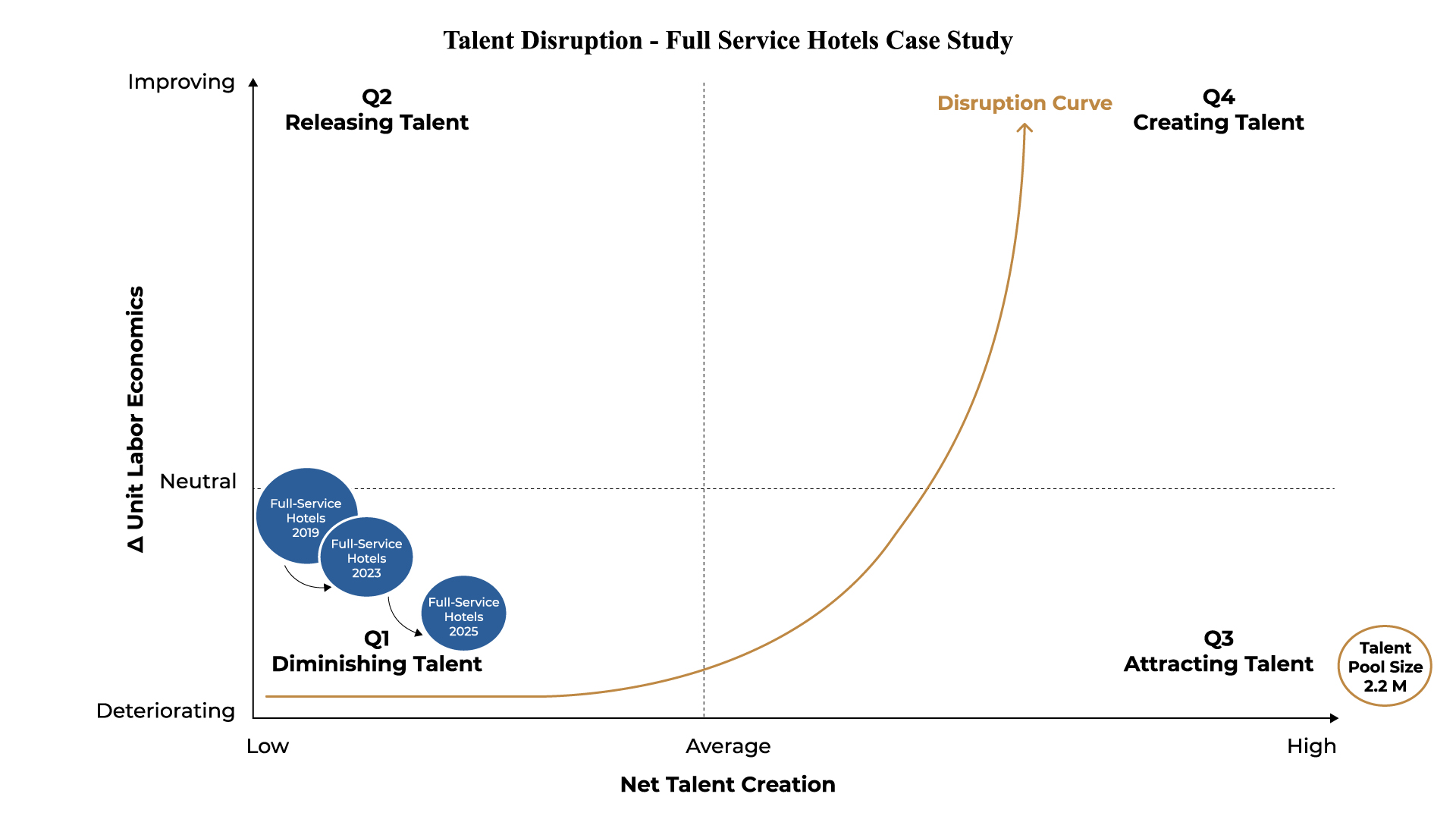

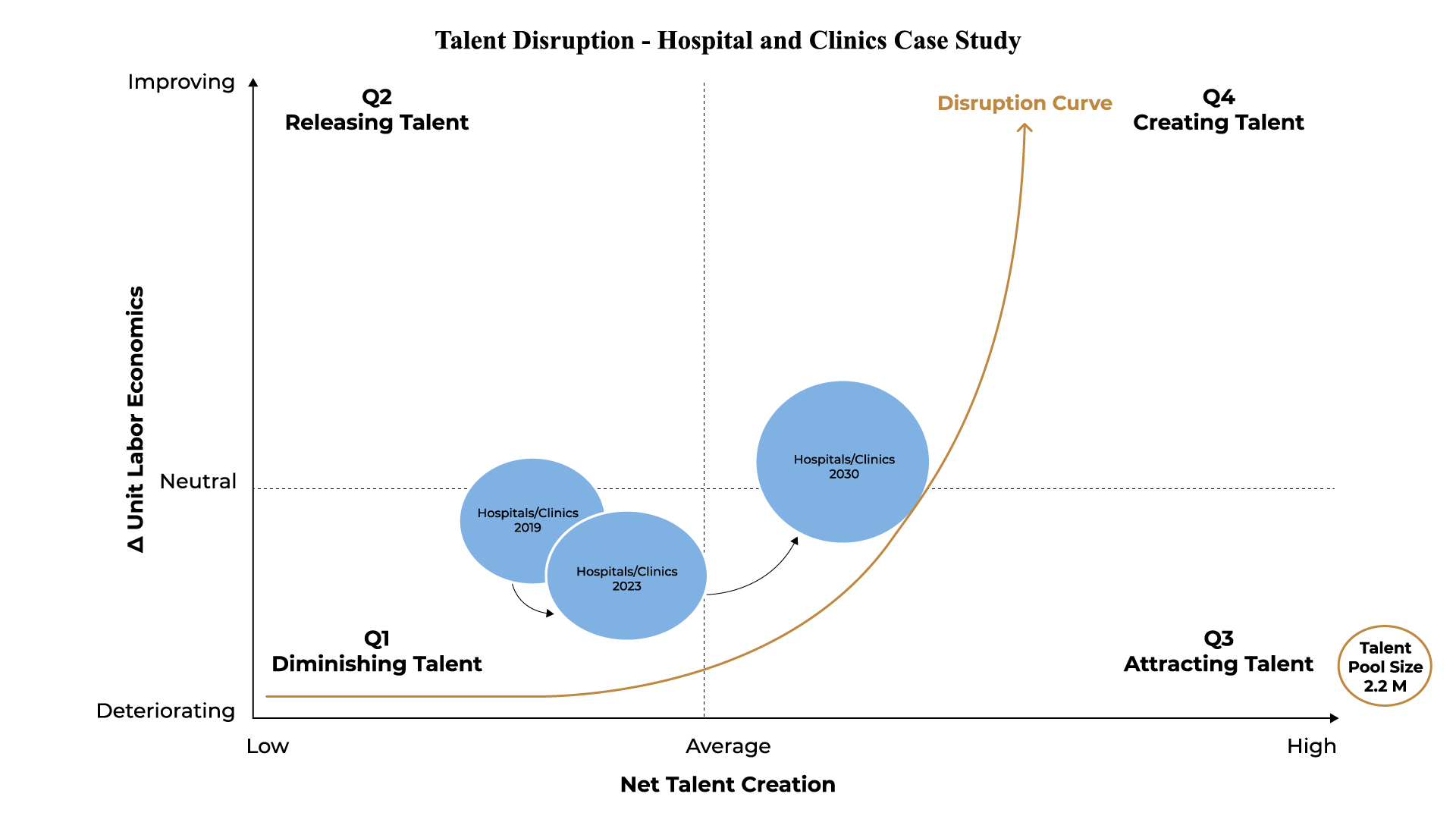

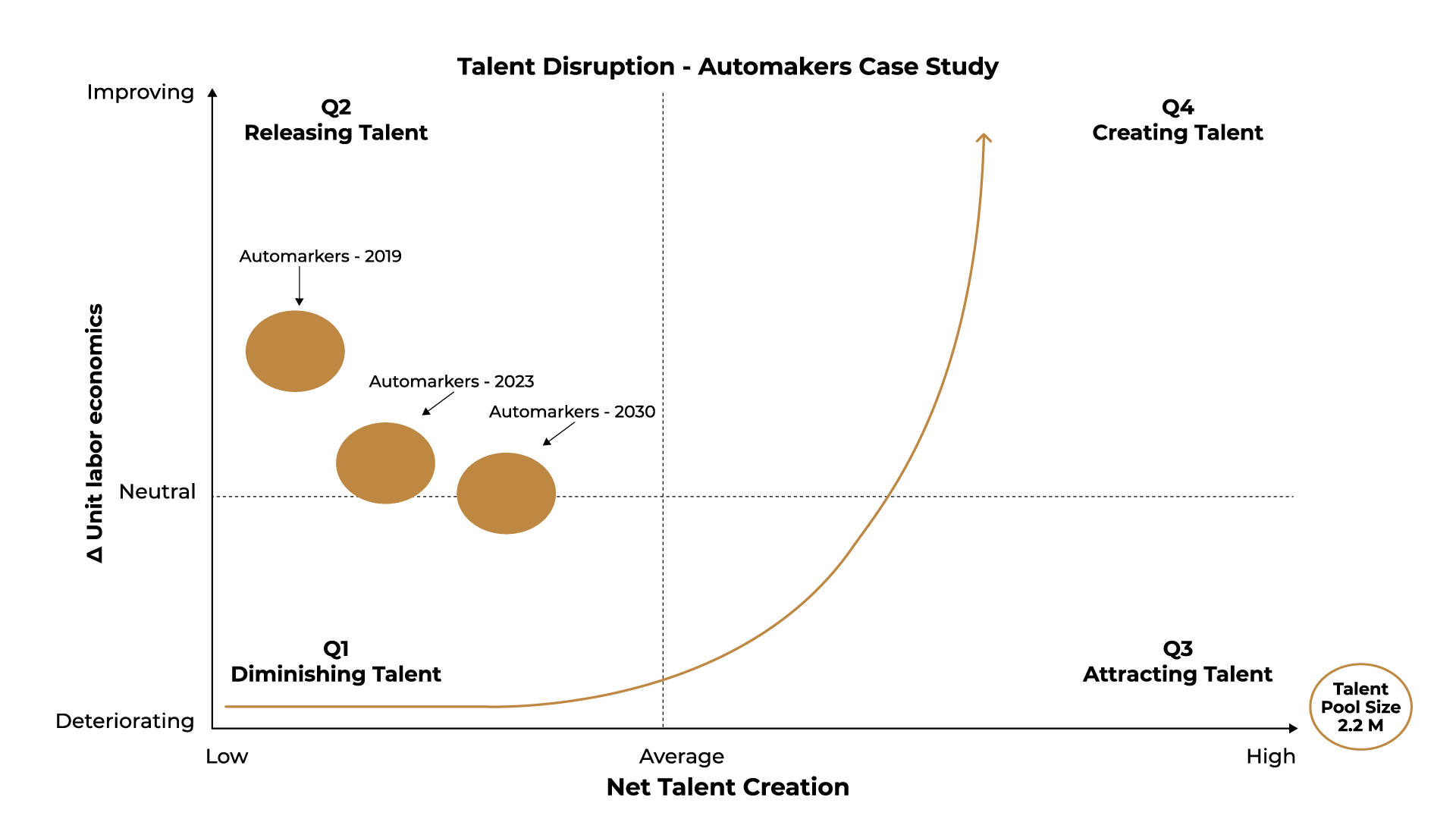

We developed a theory that predicts when talent disruption occurs along with a typology for its various forms and most importantly depending on their position, what incumbents can do to either mitigate or accelerate each type of disruption. The Talent Disruption Framework evaluates two critical dimensions: talent creation, measuring an organization’s ability to attract and retain elite talent, and unit labor economics, gauging talent costs relative to product or service output. By analyzing the disruption curve, industries, and organizations can identify opportunities to address customer needs through innovative operating models, leading to significant long-term shifts in labor markets.

Talent Disruption in Hotel Industry

Despite a labor shortage of 1.6 million workers (and a demand for 2.4 million workers annually including turnover), the main hurdle in the hotel industry is the lack of leadership. Various parties extract billions of dollars in fees from hotels for branding, asset and hotel management, taxes, and union dues yet accountability is murky. The industry’s governance structure is becoming unmanageable, with brands, owners, third-party operators, cities, and municipalities pointing fingers at each other. Hotel chains focused on franchising avoid accountability while enjoying the benefits of revenues from the topline and owner funded marketing budgets. Meanwhile, cities and municipalities extract $46 billion in taxes but prioritize advertising over labor related investments.

Unions are growing and workers have few alternatives but to join them to have a voice. Unlike airlines, frontline employees have no ownership stake in hotel properties. Hotel owners, driven by short-term profit goals, perpetuate turnover by hiring third-party managers to cut costs and exiting properties an average of every 5.5 years. Hotel operators have also been inefficient in recruiting talent, relying on legacy technologies that filter out millions of semi-qualified hidden workers. It’s imperative that industry CEOs advance alternative, market-based solutions, such as pay for performance, that demonstrate a renewed sense of purpose in building human capital.

Talent Disruption in Healthcare Industry

The healthcare industry is facing significant challenges, including rising costs, a labor shortage, and declining operating margins. The U.S. is projected to face a shortage of more than 200,000 registered nurses and more than 50,000 physicians in the next three years. In 2023, healthcare leaders expect a drop in operating margins of between 25 and 75 percent, which could place even more workload for an already stressed workforce and necessitate hospital closures and layoffs. Furthermore, the industry is seeking improvements in diversity, equity, and inclusion. For example, while 28 percent of physicians are immigrants, only 6 percent of Hispanics and 5 percent of Black people identify as physicians; 75 percent of general practice doctors are men.

However, innovative models are being adopted that shift the industry from hospital-based care to lower acuity sites and home-based care, enabled by innovative technologies. $1 trillion of productivity improvements are being ushered in by telehealth, virtual testing, and remote patient monitoring. Furthermore, the industry is responding to improve transparency and data sharing, including price transparency and data interoperability. The integration of price and quality-rating information across healthcare providers will help consumers make better decisions about where to go for care. Furthermore, the regional expansion of academic medical centers through mergers and acquisitions into distribution networks such as UCLA Health, including doctors’ offices and clinics are resulting in burgeoning talent pools for nurses, technicians, and residents. R&D has grown to over $200 billion, or 6 percent of revenue, including over $20 billion invested in building AI-driven “hospitals of the future,” and the industry has attracted over $50 billion of capital since 2021 focused on creating workflow efficiencies and using data for clinical decision support.

Therefore, as healthcare becomes less expensive and automated, less invasive, and more precise and customers have access to their data, unit labor costs for hospitals and most healthcare providers will decline sharply. This will result in reductions in admission costs per patient. Public-private partnerships in healthcare are investing in technologies such as remote monitored robotic surgeries that are also changing the nature of work. Further investments in for-profit hospitals from private equity will create more cost efficiencies that mitigate the labor shortage.

Talent Disruption in Auto Industry

A Talent Disruption has spread from hospitality, retail, healthcare, and entertainment all the way to the U.S. auto industry, with 1.7mm workers. Once again, union leaders are taking extreme positions against CEOs of publicly traded companies, who contend they’re not negotiating in good faith. Yet, CEOs seem to be out of touch, leaving them vulnerable to being blindsided by the underlying reasons for the strikes across the country: growing income inequality not seen since the late 1800s in a macroeconomic context of persistent inflation, high interest rates and high housing costs.

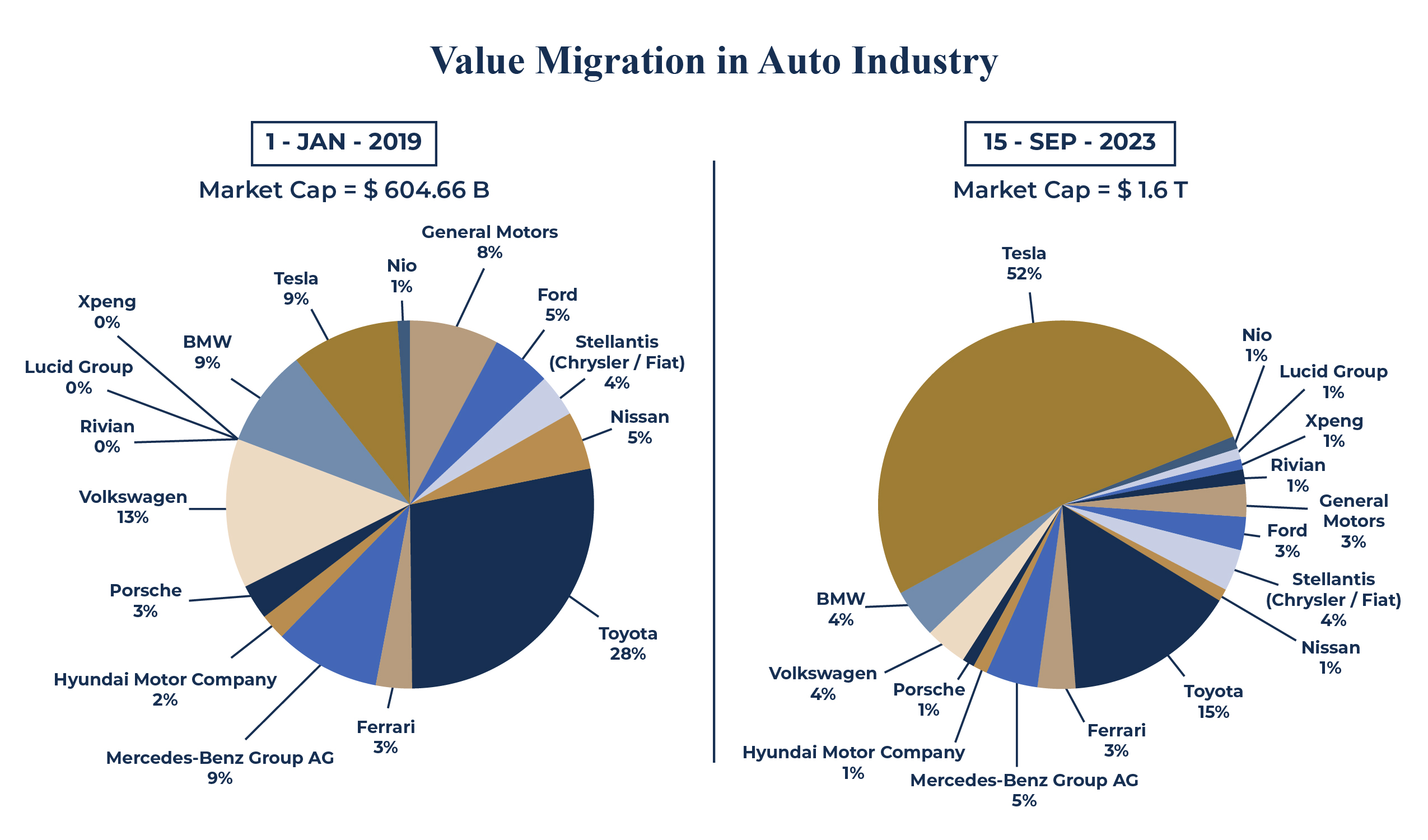

For investors in the Big 3, it was already a challenging story: between 2019-2023 YTD, the 11 incumbent auto manufacturers (Ford, GM, Toyota, BMW, Stellantis, Nissan, Toyota, Mercedes, BMW, Volkswagen, and Ferrari) dropped their share of the industry equity market capitalization from 89% to 43% while EV players including Tesla grew their share of the pie from 11% to 53%, gaining $900B. According to Alphaspread, an independent organization that calculates economic value creation, Ford and GM have $200B of debt combined and undervalued by 50-60%.

Over the last decade the auto industry has acquired significant engineering and technology talent from other industries such as Technology and Gaming. For instance, according to BCG, Ford has hired a sizable portion of its senior leadership team from leading technology players such as Apple, Tesla, Hewlett-Packard, and Amazon. According to Detroit Free Press, auto makers are partnering with states and universities to train and recruit talent for the EV industry, offering scholarships and jobs. But in terms of manufacturing, the auto industry falls in the diminishing talent quadrant and like many other industries, CEOs and management teams facing shareholder pressure, chose to focus on product innovation, sustainability, and financial engineering rather than investing in people and new labor models. Their strategic failure is costing our economy $500 million dollars a day.

Talent Disruption in Retail Industry

The retail industry, which is expected to close 50,000 stores in 2022 alone and continue investing in e-commerce automation. Given the restructuring of commercial real estate across the country, retail may permanently shrink as an employer. However, new roles in fulfillment, logistics and AI are being created, and retailers will increasingly compete for talent with traditional manufacturing, logistics, and technology businesses.